The Valeant Pharmaceuticals Case

By Yucheng Lu

This case study is about Valeant Pharmaceuticals, a Canadian-based multinational pharmaceutical company. The company is under investigation for its pricing practices, which have allegedly resulted in extremely high prices on medicines in the U.S. market. Additionally, its inappropriate disclosure of inter-corporate relations alarmed investors, who are concerned about possible manipulation of the insurance system.

This case study finds Valeant’s behavior in both healthcare and equity markets to be unethical. Stakeholders should be aware of the risks associated with Valeant.

The Core Players:

The main players involved in the Valeant’s scandal are as follows.

- Valeant Pharmaceuticals (NYSE/TSX: VRX). A multinational company, which develops, manufactures, and promotes a wide range of pharmaceutical products “in the areas of dermatology, gastrointestinal disorders, eye health, neurology and branded generics.” The company claims it adheres to its core values, including Ethics, Accountability, Creativity and Entrepreneurship, Resourcefulness, Speed, Transparency, as well as Teamwork and Talent Development, affirming its responsibilities to all stakeholders. (Valeant)

- Salix Pharmaceuticals (NASDAQ: SLXP). Based in North Carolina, Salix is a well-recognized gastrointestinal drug developer with a big portfolio of healthcare products, as well as some future game changers in their development pipeline. Valeant’s CEO, Michael Pearson, believed the acquisition of Salix would help Valeant build up its more diversified product line of specialty medications.

- Philidor Rx Services. A Pennsylvania private company providing “pharmacy dispensing services, insurance reimbursement support, and exceptional customer service to patients and physicians nationwide”. (LinkedIn Company Page) “Philidor dispenses Valeant medications before adjudication of the reimbursement may be finalized. Patients get their medicines more quickly and Valeant takes the risk for non-reimbursement.” Valeant acquired a special option to purchase Philidor in December 2014. According to Valeant’s announcement, Philidor’s financial results were consolidated with Valeant’s, but Valeant had never disclosed details about the option purchase or their factual business relations, until late October 2015. Philidor had licenses to operate in 46 states (residential and non-residential), with one of the four exceptions being California. But Philidor had agreements with local pharmacies in California and relied on them to dispense the medicines. (Valeant)

Valeant terminated its business relationship with Philidor due to public concern regarding Philidor’s business practices, and Philidor plans to shut down.

- R&O Pharmacy. As introduced in Valeant’s presentation to investors, this is a California-based specialty pharmacy in Valeant’s network. Valeant claimed R&O sold “a substantial amount of Valeant product” and requested a $69,861,343.08 payment from R&O, while R&O denied owing that amount. Valeant disclosed in October 2015 that Philidor had an option to buy Isolani LLC, which was holding 10% of R&O’s shares and had the right to acquire the remaining shares of R&O. Isolani provided “management and administrative services to R&O.” Valeant also consolidated the R&O financials. (Valeant)

- Citron Research. A private research firm, led by Andrew Left. This company aims to attack public firms with shaky financial performance or questionable business models.

- Investors. Some investors, including stockholders and creditors, had long-held positions at Valeant Pharmaceuticals. Many demanded better financial performance and higher growth from the company.

Hedge funds play important roles at Valeant. Bill Ackman, a famous activist investor managing a hedge fund called Pershing Square Capital Management, is one of the major shareholders of Valeant. Mr. Ackman has been an essential supporter of Valeant. His fund had a total share of 6.29% as of June 2016. Other large shareholders include Valueact Capital Management (4.37%) and Paulson & Company (3.87%), as of March 2016. (Morningstar)

- Consumers. People buying Valeant products, mainly patients in need of certain medications. Consumers want reliable and affordable supplies of medicine from pharmaceutical companies like Valeant.

- Insurance Companies. Insurance companies in the United States offer health insurance covering most of the costs of prescribed medication, usually with a co-payment billed to patients.

- Government. Regulatory bodies require companies under their supervision to follow the laws, thus generating social benefit. Firms disregarding social responsibilities are punished by government agencies overseeing relevant business sectors. Other punitive actions include lawsuits initiated by state and federal attorney generals or by individuals in the United States (with the court awarding punitive damages).

Some Valeant Pharmaceuticals Drugs with Rising Prices:

It is easy to list Valeant medicines that exhibit flagrant price increases. These drugs are usually old products developed by firms acquired by Valeant, and their prices were raised immediately after acquisition. Although taken by many patients in the U.S., they no longer have patent protections in effect.

- Cuprimine. This drug treats Wilson’s disease, a common genetic disorder related to copper metabolism. The disease can cause severe liver and nerve damage. “The worldwide prevalence of Wilson’s disease is estimated to be one in 30,000 individuals.” (Cuprimine.com) This medicine is vital to patients with Wilson’s disease. Patients need proper medication to lower the level of copper accumulation in the body. Therefore, the medication must be taken daily.

According to a news report by the New York Times, the Valeant “more than quadrupled” the price of Cuprimine. (Pollack and Tavernise) A patient interviewed said he would have to increase his budget for this life-saving medicine from $366 to $1,800 per month.

- Glumetza. This medicine is used to treat Type 2 Diabetes by controlling patients’ blood glucose levels. This kind of diabetes is due to inefficient use of insulin by the body, even with higher-than-normal endogenous insulin supplies. Insulin is a hormone that keeps blood sugar low in the body, by signaling body cells to absorb glucose from the bloodstream. (Hess-Fischl) An abnormally high blood glucose level will harm organs and nerves, and the symptoms get worse over time. (American Diabetes Association)

Valeant raised the price of Glumetza by “about 800 percent” after its acquisition of Salix Pharmaceuticals.

- Isuprel. A medicine used to treat asthma and heart diseases, including bradycardia and other arrhythmia. Bradycardia is a condition where the heart rate is lower than normal range, typically 60 to 100 beats per minute at rest. A lower-than-60 heart rate does not necessarily indicate illness, except in patients who have problems in their heart electrical systems. Such problems will cause insufficient supply of blood, leading to some fatal effects. (Webmd.com) Other arrhythmias work similarly – the electrical signals maintaining normal heartbeats are blocked or delayed, resulting in abnormal changes in heart rhythm. Valeant acquired this heart drug and quickly boosted the price by more than 500%. (Pollack)

- Nitropress. Also called a “Sodium Nitroprusside Injection”. Usually used in the treatment of high blood pressure, Nitropress is taken by injections. “The principal pharmacological action of sodium nitroprusside is relaxation of vascular smooth muscle and consequent dilatation of peripheral arteries and veins.” (Drugs.com) High blood pressure could damage the heart and blood vessels. It increases the risk of heart attack and stroke, as well as other type of damage to organs. (Blood Pressure Association) Valeant increased its Nitropress price by over 200% right after its acquisition.

The Acquisition, Price Inflation Business Model

Valeant usually takes advantage of its easy access to cheap money to buy drug firms producing medicines of high value to Valeant. The cash instruments required for acquisitions can come from financial institutions, such as banks and hedge fund investors.

Let’s take Salix Pharmaceuticals as an example — Valeant raised the price of Salix’s diabetes medicine Glumetza by around 800%. Valeant acquired all outstanding common shares of Salix in 2015, at a price of $173.00 per share, in an all-cash payment. The funds required for the acquisition were provided by “a syndicate of banks led by Deutsche Bank and HSBC”. (Valeant Annual Report) In FY 2014, Salix yielded an annual revenue of $1.1 million, while Valeant’s was $8.2 million.

Specialty medications, as defined by the Health Alliance Plan of Michigan and Blue Cross Blue Shield of Michigan and the Blue Care Network, are drugs requiring close surveillance by doctors and regulators, as well as special prescription and storage procedures.

Initially, the bid price of the Salix transaction was $158.00 per share in February 2015. However, in March 2015, a competitor appeared in the midst of acquisition negotiations. Endo International Public Limited Company, an Ireland-based pharmaceutical firm, with product lines covering pain management pills and other health conditions, extended an unsolicited offer to Salix. The offer was to be settled in both shares of Endo and cash, and the implied value of Salix’s shareholder’s equity in the proposal was $10.93 billion. Later, on March 17, Valeant increased its offer for Salix’s common stocks to a total value of $10.96 billion, pushing up the per-share acquisition price from $158.00 to $173.00. In response to Valeant’s new offer, Endo withdrew its offer for Salix. (The Irish Times)

Valeant, with controlling power over Salix, then raised the price significantly of Salix’s diabetes medication, Glumetza. This kind of specialty drug usually has a specified market segment, and drug firms have strong price-setting power in such markets. Valeant CEO J. Michael Pearson explained it had been a “standard industry practice” to increase the price right before the proliferation of a particular medicine’s (e.g. Glumetza’s) generic substitutes. (Pollack and Tavernise) Reuters found the prices for 4 of the top 10 medicines in the United States were more than doubled in 2011, while the other six drugs’ prices were up over 50%. The report says the egregious price-raising strategies are adopted by big players, as well as smaller ones like Valeant and Turing, but the public pays less attention to big firm price practices. These big players include companies like Teva Pharmaceutical Industries Ltd (TEVA.TA), AbbVie Inc (ABBV.N), and Amgen Inc (AMGN.O). (Humer) Although significant price increases occur quite often in the drug market, it is hard to determine whether the “standard industry practice”, as mentioned by Mr. Pearson, exists. The reason is that conventional drug firms claim they set higher prices to offset the risks associated with Research and Development. Without independent data, outsiders have no option but to blindly accept firms’ assertions.

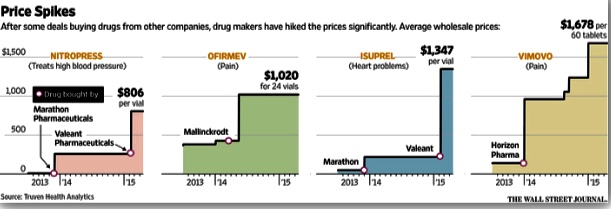

Similarly, on February 10th, 2015, Valeant acquired Marathon Pharmaceuticals’ two drug brands, Nitropress and Isuprel, described above. On the same day, the prices of the two drugs skyrocketed, as reported by the Wall Street Journal’s Jonathan D. Rockoff and Ed Silverman. In the same article, a graphic illustrates the recent increases in consumer costs:

(Source: The Wall Street Journal)

Some analysts believe Valeant found these drugs attractive, because they would not face competition from generics in the short-term, even if patent protections on the medicines expired. This protection is why firms like Valeant were confident in raising prices and nonchalant about competition. Doctors interviewed in this report said they had no choice but to continue prescribing these medications, as no good alternatives existed.

Valeant did not only buy companies, but it also used its drug distribution channels to promote the usage of expensive drugs. By controlling companies like Philidor Rx, Valeant urged pharmacy managers to consider more expensive medicines to replace the current cheap generics. (Zacks Equity Research) Philidor was also accused of intentionally changing doctor’s prescriptions to sell more Valeant medicines. The underlying logic of doing so is obvious — “Generally, a pharmacist is required to sell the generic version of a drug unless the prescription indicates to ‘dispense as written.’” (Dabney)

Public Anger over Prices

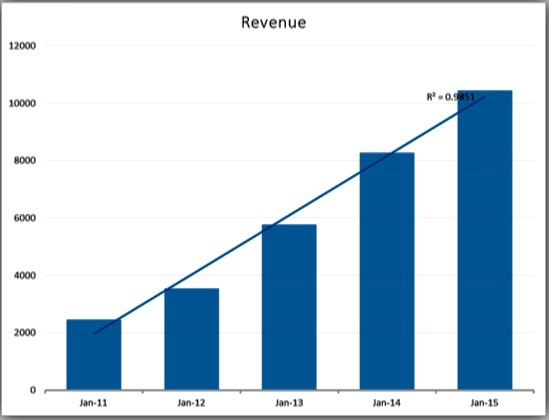

Valeant has aroused nationwide protests against large pharmaceutical corporations. The New York Times has several reports focusing on Valeant’s price setting strategies. Patients in need of the medications listed above complained about the misconduct of medical companies, including Valeant. Among those pharmaceutical firms, Valeant ranked No.1 in price raising, and Valeant’s price-raising strategy became its leading money making scheme. It is noteworthy to observe Valeant’s recent revenue growth in the following graph. Its annual revenue from FY2011 to FY2015 shows a strong linear relation with time (see the fitted trend line), with a coefficient of determination as 0.9851, which is a strong indication of constant rapid growth. The average growth rate in these years is around 40% annually.

(Source: Yahoo Finance)

Traditional drug companies rely on innovation – firms developing new or more effective medicines are compensated by higher market share and revenues. Supporters of conventional drug companies argue that compensation serve as risk premiums for the high specific business risks associated with drug development. Valeant does not invest as much funds in Research and Development (R&D) as other drug companies. Of its sales revenues, the company only allocated 3% to R&D, much lower than 15-20% in traditional drug firms. Sometimes, Valeant even cut the R&D investments after acquiring the target firms. (Citron) “More conventional pharmaceutical and biotechnology companies… have rushed to distance themselves from companies like Turing and Valeant.” (Pollack)

On Hillary Clinton’s presidential campaign website, there was a story of a poor girl named Elena Luisi. Her sister, Paola Luisi, wrote the article. Diagnosed with Wilson’s Disease, Elena had no choice but to regularly take Syprine, a specialty medicine currently owned by Valeant. Otherwise, the disease would cause fatal effects in patients like her. Valeant raised the price one year before Elena’s diagnosis.

Thanks to Elena’s father’s generous health insurance, she only needs to pay $10.00 out of $29,403.29, the so-called “retail price”, per month. However, she would have to be removed from the beneficiaries list after her 26th birthday, according to the insurance policies. Firms like Valeant are earning tremendous profits by taking advantage of those patients diagnosed with rare diseases and asking large bill payments from insurers. Insurance companies therefore, tend to avoid insurance payments for such overpriced drugs. (Luisi) Even if insurance companies are willing to pay the unreasonably expensive drug prescriptions in the foreseeable future, the insurance premiums will inevitably rise to cover the additional expense. Consumers eventually pay for these increases.

Democratic Party Presidential candidate Hillary Clinton urged the government control prices in the healthcare market. (Pollack) Former Democratic candidate, Senator Bernie Sanders (I), requested Valeant to disclose its costs of ingredients and production of certain drugs with significantly high increase in prices. (Rockoff) Robert Portman, member of the Committee on Homeland Security and Governmental Affairs, also questioned Valeant about the reasoning behind the absurd price increases of Isuprel and Nitropress. In his letter, Portman mentioned Howard Schiller, former CFO of Valeant, who, in response to public criticism, concluded their drugs were underpriced, based on their internal research on “the benefits” of the drugs. Portman further accused Valeant of never providing “any explanation” for its price increases. (Portman)

Firms like Valeant do not expect patients to pay the unbelievably high drug prices. Instead, they want the money from insurance companies, as insurance plans usually cover the larger proportion of medical expenses and only require small co-payments from policyholders in the United States. However, insurance firms are taking action to stop the coverage of certain overpriced medicines. The rising operating expense of the insurers will also result in higher insurance premiums and co-pays by consumers.

Shareholders’ Nightmare

Price gouging is not the only misconduct perpetrated by Valeant. This fast-growing company was also criticized for its misleading financial disclosures. Warren Buffett, chairman of Berkshire Hathaway, declined to invest in Valeant due to its unsustainable growth model and the management’s lack of integrity.

Citron Research, known for its investigations on short-selling strategies, published a report aiming to challenge Valeant’s accounting policies. Citron Research claimed Valeant had already been “the pharmaceutical equivalent of Enron.” (Goldstein, Stevenson, and Eavis)

The event was triggered by a small California-based pharmacy, R&O Pharmacy. On September 4th, 2015, R&O received a letter requesting a $69 million payment from Valeant, even though R&O did not have direct business relations with Valeant. R&O concluded only one of two things could explain the payment request from Valeant: first, both Valeant and R&O were “victims of a massive fraud perpetuated by third parties” or second, Valeant tried to defraud R&O. R&O Pharmacy therefore filed a lawsuit against Valeant in federal court, seeking a declaratory judgement assuring R&O owed Valeant nothing. (The United States District Court for the Central District of California)

In Citron’s report, the author pointed out that Valeant had an affiliation with R&O, in the sense that Valeant’s stakeholder, Philidor Rx, had listed the same contact address and phone number as R&O’s on their website and that Philidor had purchased an option to buy Isolani, which was a major shareholder of R&O and acquired a similar option contract to buy all shares of R&O. What’s more surprising was that Valeant was Philidor’s only client and Valeant also had an option to purchase Philidor. Based on this attenuated chain of potential control, Citron claimed Philidor might have owned R&O. After Citron released a series of reports, Valeant explained that Philidor provided back end services for R&O, which was very doubtful. (Valeant) That means Valeant, Philidor, and R&O could be placed under the same corporate umbrella. In this case, potential accounting misstatements needed scrutiny.

This kind of option contract between Valeant and Philidor has a technical name, “Variable Interest Entity” (VIE). In a CNBC report, “Are Valeant, Philidor and R&O all the same company?” Alex Rosenberg explained, “a company that holds a VIE generally enjoys exposure only to the upside of its results, or only to its downside, or it directs the actions of the company.” According to the Financial Accounting Standards Board (FASB), Valeant should list its VIE holdings on its balance sheet, and Valeant did. However, whether and how exactly Philidor should consolidate R&O’s results are not clear. Valeant’s management had worked it so well that outsiders could hardly see the connections among these firms. R&O may or may not be described as an entity indirectly owned by Valeant, depending on how you interpret the option contracts involved. The answer is obscure, due to the lack of transparency.

The accounting standards might have been vague regarding this kind of special corporate relation, but analysts thought the lawsuit between R&O and Valeant seemed to be stranger, if they had the close relationship. Rosenberg believed such a lawsuit helped Valeant make some favorable changes on their statements. According to the accounting experts interviewed by Rosenberg, Valeant should have disclosed clear details about Philidor and R&O, but the management simply did not.

Suspiciously, Valeant has never specifically and explicitly disclosed its transaction details of the option contract (namely the VIE) on Philidor, but it profitably consolidated Philidor’s financial results into its financial statements. Why did the publicly listed company not disclose the details about its true relation with Philidor, given their close and long-term cooperation? Was Valeant trying to hide this business partnership to defraud other parties?

As explained in Valeant’s presentation to investors, Valeant had no obligation to disclose its relationship with Philidor, because the dollar amount of this option transaction was lower than a threshold defined in the Generally Accepted Accounting Principles (GAAP). If their calculation was right, then Valeant, as usual, did not violate any laws per se but again acted unethically.

In February 2016, Valeant informed the public the company was under investigation by the U.S. Securities and Exchange Commission (SEC). The probe was fundamentally about the drug firm’s relationship with Philidor and triggered a 20% drop in Valeant’s stock price.

Later, U.S. prosecutors also announced a criminal investigation of Philidor, as reported by major news agencies on August 10th, 2016. The U.S. Attorney’s office in Manhattan focused on whether Philidor and Valeant intentionally hid their relationship from insurers. The crux of the investigation is whether insurance companies realized Philidor was pretending to be neutral, while being affiliated with Valeant. By doing so, Philidor could get Valeant’s medicine covered by insurance plans as a seemingly independent entity. The Wall Street Journal reports Philidor used “aggressive tactics to get insurance companies to pay reimbursements for Valeant’s often high-price drugs.” Philidor was found to be altering prescriptions with intent to fill more prescriptions with Valeant-branded medicines. (Durden) Valeant may have been conspiring with Philidor against insurers, so Valeant could get insurance companies to pay for its expensive drugs.

Ethics Analysis – Price Increases

Exploitation. Regardless of patients’ rising medical costs, Valeant continued its harmful pricing schemes. The ethical problem with Valeant’s form of price gouging is it is wrongfully exploitative. The key concern is that it is unfair for a seller, in this case Valeant, to take advantage of buyers vulnerability to derive disproportionate benefits to Valeant’s management, even if consumers of the drugs benefit to some degree as well. High retail prices may not be a problem for consumers with adequate coverage from their current insurance plans. However, people without access to good health insurance would be in danger, because they cannot pay the high monthly medical bills. Specialty medications are usually specifically designed for patients with rare diseases. Therefore, it is always difficult for patients to find cheap and easy-to-obtain substitutes. With the fatal outcomes associated with certain rare diseases, patients would be at risk of death, thanks to predatory drug firms like Valeant.

Damaging the Integrity of System.Other consequences may include higher average insurance premiums and growing proportions of copays in total costs. Either most people would face higher costs of insurance, or they would pay larger amounts of co-payments for each prescription billed to them. Sometimes nationally backed insurance programs with higher operation costs would demand more money from taxpayers. The question is why do people have to pay more for old drugs with no additional improvements or innovation?

Rent Seeking not Innovation. It is ethically acceptable for traditional pharmaceutical companies to charge reasonable amounts for medicines they developed through taking risks and making innovations. This compensation scheme serves as a mechanism by which the market encourages companies to compete in developing new and cutting edge medicines. However, Valeant’s success does not derive from Research and Development. Instead, its business model is to acquire extant drug companies and enrich itself by raising the prices of their current products. In other words the company is engaging in rent seeking behavior which results in reduced economic efficiency and poor allocation of resources.

Upshot. Valeant’s pricing model is unethical because it harms people and the integrity of the insurance payment system. The only parties that benefit from the price gouging of this type are Valeant’s management and its owners. No matter how much patients must pay for their lifesaving medications, owners and business leaders of Valeant do not lose a penny. Management will receive higher compensation if there is great short-term business performance. Still, the total amount of social welfare loss eventually overwhelms individual monetary gains from such pricing schemes. It is simply unjust that greedy management, directors and investors should extract profits from the suffering of the sick.

Ethics Analysis – Stock Price Drops

Lack of Transparency. Valeant was non-transparent and dishonest with information it provided. Outsiders could were confused and unclear about the relationship between Valeant, Philidor, and R&O. The lack of transparency allowed Valeant to show inflated financial results, as it still wanted to be the darling of Wall Street. However, this kind of behavior not only lacked the virtue of honesty but also violated the company’s fiduciary duty to shareholders. Valeant therefore was not virtuous and its action broke ethical rules.

Shareholders suffered disastrous losses holding Valeant’s shares. In late September 2015, when the inter-company transactions scandal was exposed, VRX’s price was around $200. It dropped to about $25 by Aug 11th, 2016, a loss of 87%. Valeant’s large shareholders, including Sequoia Fund and Bill Ackman’s Pershing Square Capital Management, lost large sums of money as VRX imploded.

Fails Utilitarian Test. Nor did management benefit from the lack of transparency. Former CEO Michael Pearson was fired, following a deposition order from the Senate Special Committee on Aging. (Fortune) Some analysts were glad he left the company, adding that Valeant should change their unsustainable business model. “Until Pearson is out of there, they can’t do that.” (Wang and Wapner) Similarly, former CFO, Howard Schiller was asked to resign because “an internal investigation had identified ‘improper conduct’ by Schiller and another former employee that led to Valeant’s misstatement of financial results”. (Wieczner) Shares of Valeant jumped on the day when its new CFO Paul Herendeen was appointed on August 22, 2016. (Reeves)

Valeant’s unsustainable and unethical business model can drag the share price down in the long run. Legislative bodies will not allow constant price increases in the market and will make new rules to stop the drug price increase frenzy. In Valeant’s 2015 annual filing, management expected its operating cash flow to be lower when drug price limits are inevitably imposed on the market. (Morgenson)

Upshot. Valeant was dishonest and its faulty information disclosure resulted in more bad than good consequences. Hiding important financial information is an act of deceiving investors. Valeant had been dishonest, even though it could claim it was not in violation of any current laws. Lawfully concealing Valeant’s relationship with Philidor and R&O is how Valeant managed to distract public attention from its business distribution channels. Biased or partial disclosure is by no means ethical business behavior, and it is a sad joke that Valeant lists Ethics, Accountability, and Transparency in their core values.

Conclusion

Valeant’s drug price strategy, growth model, and accounting methods are not ethical in any respects. To achieve ethical and stable business practices, this company needs to replace both management and the company’s real core culture and practices. As cited in Citron’s research report, Pearson once urged outsiders to understand their business. But how is a value-creating business so difficult for investors to understand? Perhaps smart outsiders did understand the business model and recognized it as predatory and unethical.

Editor: Eric Witmer

-x-

Works Cited

Complaint for Declaratory Judgement. 2:15-cv-07846 ed., 2015. Print..

Citron Research. Web.

“Facts About Type 2.” American Diabetes Association. N.p., 27 Oct. 2015. Web. 23 July 2016.

Hess-Fischl, Amy. “What Is Insulin?” EndocrineWeb. N.p., n.d. Web. 23 July 2016.

“Introduction.” Cuprimine Home. N.p., n.d. Web. 23 July 2016.

Valenat Investor Conference Call Presentation, October 26, 2015. Web.

“What Is High?” Blood Pressure : What Is High Blood Pressure? N.p., n.d. Web. 07 Aug. 2016.

Wieczner, Jen. “Valeant Infighting Is Getting Nasty.” Fortune: Valeant Infighting Is Getting Nasty Comments. Time Inc., 20 Mar. 2016. Web. 31 http://fortune.com/2016/03/21/valeant-howard-schiller/Aug. 2016.